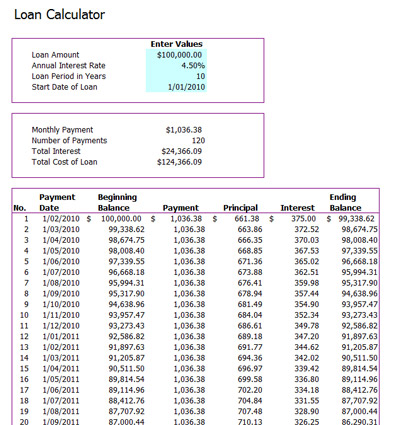

Mortgage amortization is a financial term that refers to the process of paying off your mortgage in monthly installments according to an amortization schedule. Payoff date: This is the estimated date by which you’ll have paid off your entire loan.Total cost of the loan: This is the total you’ll pay on your mortgage, including both principal and interest.Total interest: This is the total amount you’ll pay in interest charges over the life of your loan.Typically, your payments will cover more interest earlier in your loan term while later payments will be mostly applied to your principal. Your monthly payments will be divided between principal and interest. Interest is what you pay the lender in exchange for borrowing money. Principal and interest: Your loan principal is the exact amount you borrow from the lender.In this case, you could opt to recast your mortgage, which won’t change your loan term or interest rate but can lower your monthly payments with a shorter amortization period. Lump-sum payment: If you have extra money in the bank, you might decide to put it toward your mortgage-this is known as making a lump-sum payment.This can also save you money on interest. Extra payments: If you’d like to pay off your loan faster, making extra payments could be a good strategy.A portion of this will go toward your loan principal while the rest will go toward interest. Monthly payment: This is how much you’ll be required to pay each month.For example, if you have a 15-year loan, you’ll make roughly 180 monthly payments. Number of payments: This represents the total number of monthly payments you’ll make over the loan term.Common mortgage terms include 10, 15 and 30 years, though other terms are also available. Loan term: This is the number of years you have to repay your mortgage.Your mortgage interest rate represents how much you’ll be charged in interest, expressed as a percentage of your loan principal. Interest rate: Lenders charge interest in return for allowing you to borrow money.Loan amount: This is the amount you borrowed from your mortgage lender to cover the purchase of your home.Mortgage Amortization Calculator Definitions You also have the option to indicate if you plan to make any extra payments to get an idea of how much you could save on interest and if you could shorten your repayment time. You’ll also see your total interest costs and total repayment costs as well as your estimated payoff date. After entering the loan amount, repayment term, interest rate and loan start date, you’ll see how much your monthly payments will be and how many payments you’ll owe over the life of the loan. All investing comes with risk, including the risk of loss.How to Use the Mortgage Amortization CalculatorĪ mortgage amortization calculator can be a helpful tool to estimate how your payment schedule will break down month by month.

Past performance does not guarantee future results. Neither personalized nor tailored services should be construed as a guarantee of a particular outcome.

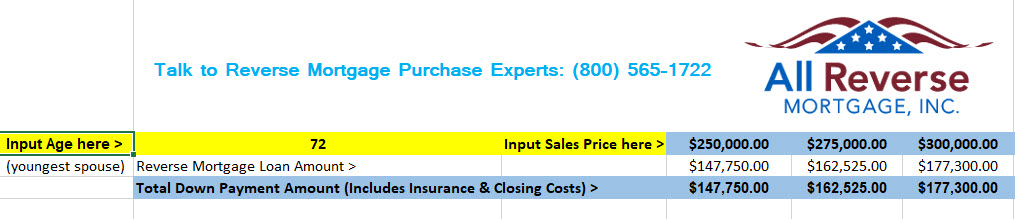

If website visitor makes use of the reverse mortgage calculator contained within or linked to this site, he or she acknowledges that the information resulting from the use of any such calculator is intended to be used for illustrative and educational purposes only and is not, and should not be construed, as the receipt of, or a substitute for, personalized individual advice from Retirement Researcher, LLC or from any investment professional. Not all services will be appropriate or necessary for all clients, and the potential value and benefit of the adviser’s services will vary based upon a variety of factors, such as the client’s investment, tax, and financial circumstances and overall objectives. Inclusion of the reverse mortgage calculator on this page should not be construed as advice or recommendations regarding the appropriateness of a reverse mortgage to a viewer’s individual circumstances.

0 kommentar(er)

0 kommentar(er)